SeedTime Money has partnered with CardRatings for our coverage of credit card products. SeedTime Money and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

I often get asked about the money tools and money apps that I use. Like what credit cards I recommend, or budgeting software, or how I invest.

So, I decided to put it all in one place for your convenience and give you a peek inside my wallet as well!

Listed from left to right:

- My Saddleback wallet – love that thing

- A well-worn photo of the love of my life

- My TN driver’s license

- The debit card that I never use (only as a backup)

- Chase Sapphire Preferred® Card (details below)

- Medi-Share insurance card (details below)

- Ink Business Preferred® Credit Card (details below)

1. My go-to app whenever I buy anything

This is one of my secret weapons. It’s called Rakuten (currently a $30 signup bonus too) and it is so simple and quick a 5-year old can do it and if you ever buy anything, you will save money.

Watch the quick video below to see how to save hundreds every year…

The only 2 credit cards we use

Last we counted, we have received 161 hotel nights and 97 flights for FREE using credit card points and as a result, I am a big proponent of rewards cards.

Even though I have opened probably 25+ credit cards in the last 10 years, these are the best that I have found. And that is why they are the only 2 in my wallet.

2. Chase Sapphire Preferred® Card

As a financial blogger, I hang out with many other nerds who love stuff like this, and almost everyone I know uses this card.

Cardratings has them listed as their top pick for travel rewards as well.

I have used this card as my primary card for 6 years now.

Why I love it

- It rewards you with Chase Travel(SM) points (which are just the best value and options that I know of).

- Earn 60,000 bonus points after $4,000 in purchases in the first 3 months from account opening. That’s worth $750 when redeemed through Chase Travel.

- Enjoy benefits such as 5x on travel purchased through Chase Travel(SM), 3x on dining, select streaming services, and online groceries, 2x on all other travel purchases, 1x on all other purchases, and $50 annual Chase Travel(SM) Hotel Credit, plus more.

- You get a 25% bonus on point redemption if you use Chase Travel(SM) portal.

- The card has a $95 annual fee, but the signup bonus pays for that many times over so I have never really cared about that personally. The benefits I get from this card so far outweigh the annual fee that it is an afterthought for me.

All that to say, if you only want one card that pays fantastic travel rewards (or cashback if you prefer), this is the one I would recommend.

Find out more about the Chase Sapphire Preferred® Card here

3. The Chase Freedom Unlimited®

This card is #2 for me.

It doesn’t have all the perks and benefits of the Chase Sapphire Preferred® Card, but it does have 2 things going for it:

- No annual fee

- And you earn 5% cash back on travel purchased through Chase Travel(SM), 3% cash back on drugstore purchases, 3% on dining at restaurants (including takeout and eligible delivery services), and 1.5 points on all other purchases.

They currently have an intro offer going on – Earn an extra 1.5% on everything you buy (on up to $20,000 spent in the first year) – worth up to $300 cashback. That’s 6.5% on travel purchased through Chase Travel(SM), 4.5 % on dining and drugstores, and 3% on all other purchases.

Find out more about the Chase Freedom Unlimited® here.

4. Ink Business Preferred® Credit Card (for biz owners)

I wrote about how this is the only card I use for my business here, so I won’t go into all the details again.

But, this card is insane in that it pays 3x points on the first $150,000 spent on purchases on travel, shipping purchases, Internet, cable and phone services, advertising purchases made with social media sites and search engines.

So if you have a business where you buy online ads, definitely get this one. If not, it is still a really good business card, but the Chase Business Unlimited would probably be a better bet.

Learn more about the Ink Business Preferred® Credit Card here

The Financial Tracking tools we use

5. RocketMoney

Currently, my favorite way to track spending and monitor where every dollar is going is with RocketMoney.

For a long time, we recommended Empower Personal Dashboard for this exercise, but we have since come to like Rocket Money because it works a bit quicker and better. But if you would like to see our tutorial on using Empower Personal Dashboard then you can click here to watch that tutorial.

If you want to get a big picture snapshot of your financial picture (without the Quicken nightmare), then it is worth checking out.

Watch the video below for a quick walkthrough on how to track your spending using the RocketMoney app.

The Banks we use

6. Ally Bank

I love this bank for a few reasons:

- They always have industry-leading interest rates in their savings accounts.

- They have eliminated overdraft fees.

- They have chat support so you can get answers without having to call.

Additionally, we have found that they work better with our Real Money Method than any other bank we have found.

Our runner up is Capital One 360. Still a great bank, but it just seems like they aren’t innovating nearly as well as Ally has been these days.

7. A local bank

Even though we probably could get by using Ally for all our banking needs, it is still nice to have a local branch every once in a while. So this satisfies our brick-and-mortar banking needs.

8. The money-management method we use

After testing out pretty much every budgeting app and software out there and still found that we were HATING budgeting, we decided there had to be a better way.

And so we developed an alternative to traditional budgeting that is easier, quicker, and simple enough Linda would use it. It’s called The Real Money Method.

To date we have taught the method to over 1500 students and this is just a small sampling the testimonies and miracles that have resulted.

The Insurance we use

9. Health Insurance

We have used Medi-Share as our health insurance alternative for the last 10 years. They have been great to work with and I recommend them.

You can check read our Medi-Share review here for all the details.

10. Life insurance

Like 98% of people we are best suited with term life insurance. It is the simplest to understand, the cheapest, and the easiest to get started.

I don’t have an affection for any particular life insurance company, but I do really like Policy Genius for getting quotes and comparing rates. Many of the comparison tools out there are obnoxious, confusing, and are hard to wade through.

This site actually creates a good user experience when comparing insurance rates, so they are my go-to tool for insurance shopping.

11. Auto Insurance

I don’t have a company that I particularly love, but definitely shop around – even when you think you have a good rate. I knocked my annual bill down by $530 in on year, just by checking rates.

The Investing tools & apps we use

If you are a new investor wanting to get started, I highly recommend our 10x Investing course where I teach our students exactly how I have gotten 10x returns on my money over my last 16 years as an investor.

There are so many get-rich-quick schemes out there right now and this course is the antithesis. Instead, it teaches proven and time-tested investing strategies for the long-term so you can invest wisely, have the best opportunity for long-term growth, all while reducing risk.

In the course we cover all the strategies and tools I use, but here are a few to get you started:

12. Acorns

This is one of my favorite money apps out there. Simply put, it is the easiest way to start investing with no money. They just round up all the purchases you make to the next dollar and invest the difference.

So, say you go to the grocery store and spend $16.25, they will round up to $17.00 and take the 75 cents and invest it. If you do that over and over, it quickly adds up to some big savings.

By far, the easiest set-it-and-forget-it way to get started investing. Here is how it works:

You can learn more about them here.

13. Fundrise

This is the easiest way to invest in real estate that I have found.

We actually sold our rental property shortly after realizing that our Fundrise returns (which are 100% passive income by the way) beat our returns on our rental property.

Click here to read my full Fundrise Review with all the details of this experiment I ran.

14. Sofi Investing

This is my favorite place for new investors to buy ETFs, stocks, and common cryptocurrency.

They are unique in that they do all 3 of these things (that very few online brokers do):

- They allow you to buy fractional shares. So if the stock price is at $200/share, but you only have $50 to invest, you can buy 1/4 of a share. Not many online brokers do this.

- They offer a ROTH IRA option – this is a must in my book.

- They have a super-simple user interface. I have accounts at 10-15 online brokers and Sofi is by far the easiest and simplest to use.

My runner up is Robinhood, but at this point they don’t offer a Roth IRA.

15. Retirement Estimator

If you are wanting to see how you are doing at reaching your retirement goals, this is a goodie. I mentioned Personal Capital up above for financial tracking, but they also have a free tool built in to help me see if I am on track for my retirement goals.

It is really helpful to see how increasing your savings amount by $50 a month can impact your retirement nest egg.

16. Vanguard

In an industry wrought with fees and middlemen trying to get a cut, Vanguard is really something unique and special with the index funds and ETFs they offer.

Warren Buffett just recently won a 10-year bet that the S&P Index Fund (which Vanguard offers) would beat out a collection of hedge funds (with outrageous management fees) and not only was he right, but it won by more than 3x!

You can invest in these Vanguard ETFs at Sofi Investing.

Credit Reporting Tools

Admittedly I don’t use these much anymore since we paid off our debt, and since we don’t plan on borrowing ever again, I don’t really care what my credit score is.

I generally suggest checking them annually just to make sure there aren’t errors on there harming you.

These are the tools I used in the past and are the best (FREE) options I know of:

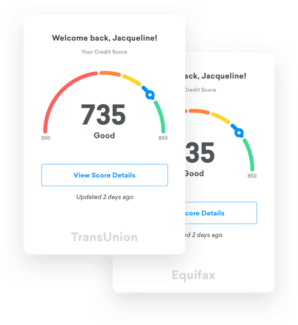

17. Credit Karma

These guys will do about everything and for FREE:

- Check your credit reports (Transunion and Equifax)

- Check your credit score

- Monitor your credit report for you

What I love about them is that they monitor your credit report for you, just in case you forget to check it each year.

18. Annual Credit Report

As you probably know, there are 3 different credit reports. Credit Karma only checks 2 of them, unfortunately. So you can use this site to get the other one (Experian).

I’ll continue to update this post as I think of other money tools and money apps that we use and love.

Got any great ones you recommend?

Let me know down in the comments!

SeedTime Money has partnered with CardRatings for our coverage of credit card products. SeedTime Money and CardRatings may receive a commission from card issuers.

DISCLAIMER: I’m a Certified Educator in Personal Finance (CEPF®), but am I not your financial advisor, so do your own research! This article, the topics discussed, and ideas presented are Bob’s opinions and presented for entertainment purposes only. The information presented should not be construed as financial advice. Always do your own due diligence. Any references to interest rates, promotions, and websites are subject to change without notice. We do our best to keep the information current, but things are always changing so it may be different now than when it was first published. Additionally, all the pages on SeedTime Money help us pay the bills by using affiliate relationships with Amazon, Google, eBay and others but our opinions are NEVER for sale. Find our more here.

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.